Western Union or WU has been a global leader in money transfer. It is a payment service provider that aims to help people worldwide send money conveniently through retail, online, or mobile channels.

Unlike other providers, Western Union allows cross-border, cross-currency transfers in over 200 countries with approximately 600,000 physical locations. They are also available to transact with billions of bank accounts and mobile wallets for hassle-free payouts.

Did you know that digital banking offers many benefits and this includes the convenience of being able to transact from anywhere? If you're interested in opening an account with a digital bank, then here are the top 3 names in the industry to consider:

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

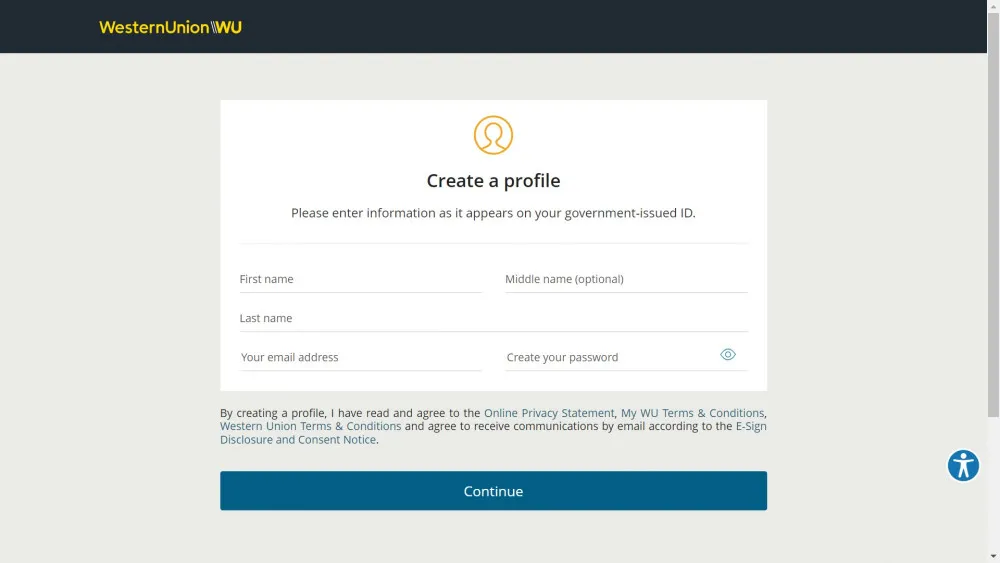

Creating an online account with Western Union doesn't need much time. You can follow the simple procedures below to register your profile in 3 simple steps:

Setting up online accounts allows you to make a quick and reliable transfer nationwide and worldwide. Having a Western Union online profile will enable you to send money 24/7 anytime and anywhere, track your transfer, know precisely where your money is, get notifications for every transaction you have made, and get rewarded for every transaction like fee reductions.

In addition, by having a Western Union online account, you can enjoy their three primary money transfer services or cash-to-account services:

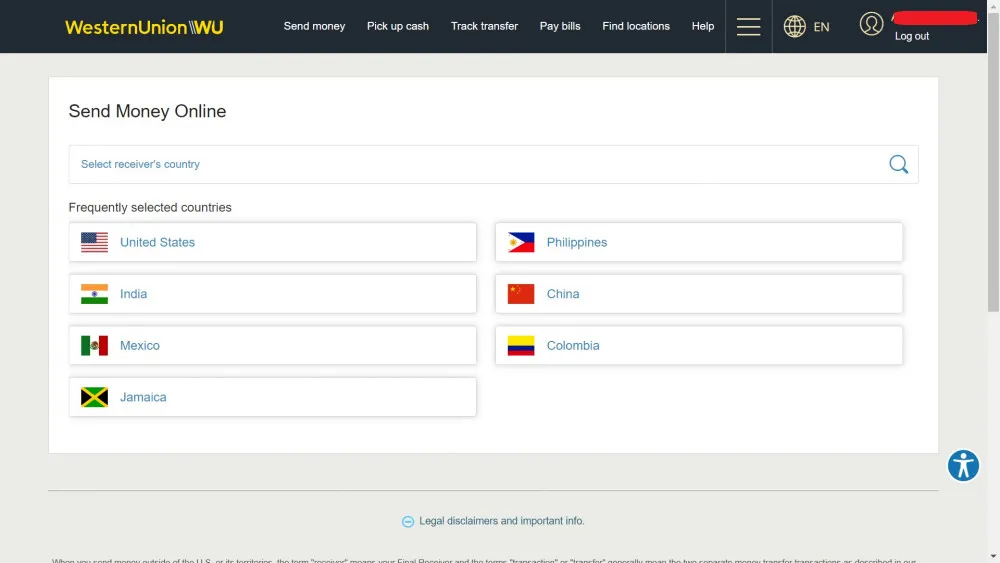

For easier transactions, Western Union has a mobile transfer app that will allow you to enjoy the following features:

Just by using your smartphone, you can make online transactions and get status updates, and get notified whenever the recipient receives the money. The best thing about this is that it saves you the time of lining up in physical locations to pay.

By downloading their app, you can make the transfer and then have the option to pay in cash via an agent or connect your credit/debit card, Apple Pay, or online bank account for faster payments.

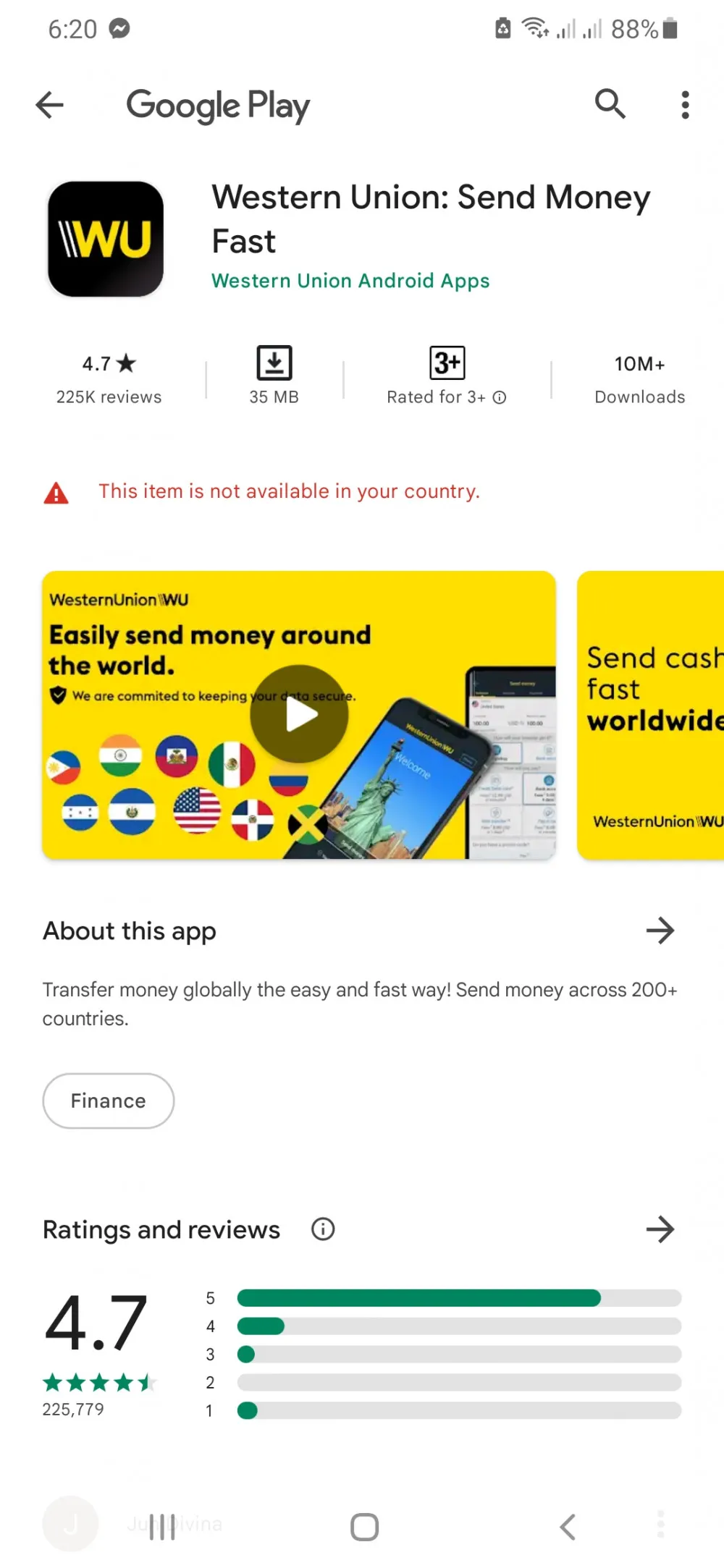

You can easily download the app from the Apple App Store for iOS or Google Play for Android devices. For new users, all you have to do is set up an account and verify using a valid ID.

The Western Union interface is clean and organized with all features seen on the screen. It asks for your details with features such as special card scanning to lessen input errors and "Repeat Transaction" options for frequent entries. It also displays a summary tab to easily determine the fees or costs.

The WU app keeps your money secured by its several security aspects such as enabling touch ID for login, use of encryption, and compliance with PCI DSS for data protection.

Western Union has a website option that has the same functions as its mobile version. However, the app may not be available in your country.

Money transfers can be done easily with the Western Union money transfer app. Here’s are some of its features:

What's great about Western Union is that they are transparent when it comes to fees in its money transfer transactions. The recipient will receive the same amount shown on the transaction page, and there will be no deductions. Sending money has no maximum transfer limit but there is a minimum transfer limit of $1 in every transaction.

Take note: Western Union has a transfer fee and it varies. The fee estimates between $0 to $150, and this can change due to certain factors such as:

Also, take note that bank transfers charged less compared to credit and debit card transfers.

The exchange rate also affects the money transfer fees. It will show you the rough estimate but the actual rates will be determined when the system asks you to confirm the transfer. These exchange rates will be calculated based on the interbank rates available in the market, plus an exchange rate margin. Therefore, you'll need to know the rates, which you can also see in their app, before transacting through Western Union.

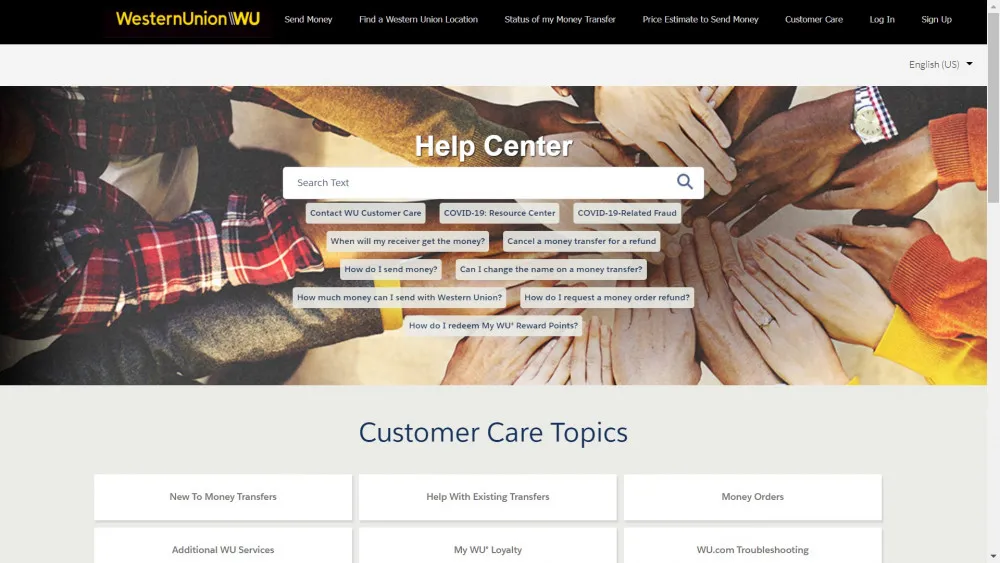

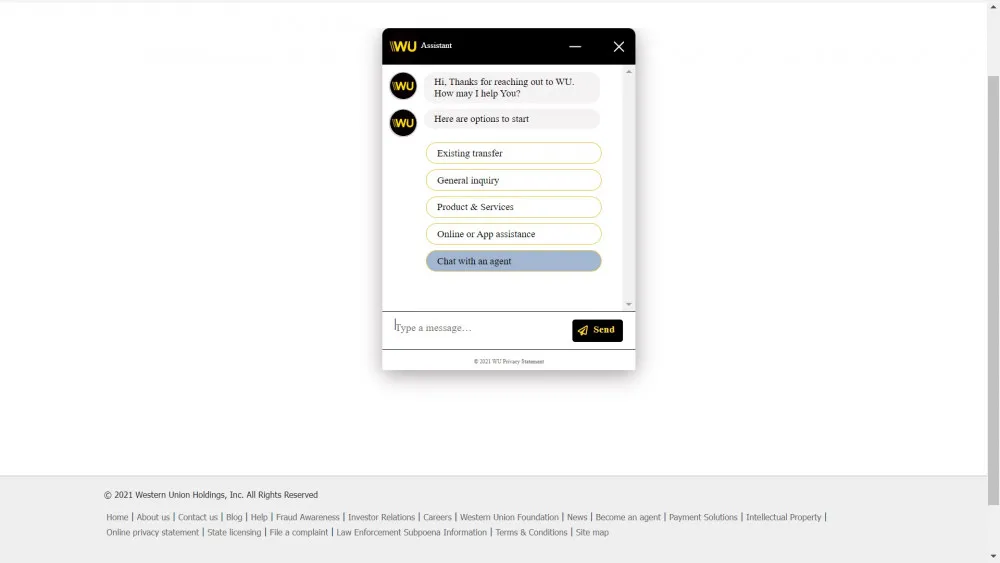

Western Union's customer support is available 24/7. It offers a different way of contacting customer support.

It is also easy to trace the status of transfers, which is often the first thing many of us want to do if we are concerned about the placement of our funds.

If you're looking for basic facts and commonly asked questions, the Western Union Help Center is a recommended place to start. You will get a response right away with its auto-generated feature.

You may also chat with a representative or email Western Union with your question or concern. Email can be the simplest and easiest way to communicate with them. However, the downside of this is that you will not get a response right away. You can also chat with their representative and if you prefer to speak to someone by phone, you can do so since they are available 24/7. You might receive the response you need as soon as possible as long as there's no technical issues with their system.

Additionally, there is even a postal address for inquiries and communications if you want to do it the traditional way. It's nice to know that you can still use this option but don't expect a fast resolution to your issues or concerns via this method.

In general, Western Union gives you different ways to contact them but if you need a quick response, we advise you to give them a call as this is the easiest way to get a response and your concern or question can be addressed right away.

Western Union is one of the largest money transfer service providers in the world and is a global leader in the industry that has established its brand to be reliable. They are widely known for sending money abroad and domestically.

Their digital option for money transfers, particularly their WU mobile app, which is available for all iOS or Android device users, is a great addition since most transactions nowadays are done online and it's good to know that they have embraced all things digital. It is designed for you to send money, track your transfer, view exchange rates, and choose your payment option and the receiver's payout preference.

There's also the website version as not all countries have access to the WU app. It still does provide the same services and features. To get started, you first need to register and verify your account, and then you're good to go.

In summary, Western Union (WU) remains to be one of the best options for sending money and when you choose to avail of their services, you can expect fast and hassle-free transactions because of their wide variety of money transfer channels via their physical stores, website, or mobile applications. Although fees may be more expensive than other providers, it offers several options for payments and receiving money which is beneficial for both senders and recipients.