| 👍Bankopedia's Recommended Broker: |

|

| Interested with trading? Then Bankopedia highly recommends eToro. This online brokerage firm is licensed by the FCA, CySEC and ASIC, which guarantees that your funds are safe. eToro offers a free demo which requires no commitment. Simply open an account so you can explore their platform without any risks. Should you decide to continue trading for real, the minimum deposit starts at $10. | |

Chime offers various cards that have plenty of banking features that you can take advantage of. Continue reading this page if you want to know more about these features and get further information about the cards that are provided by this bank.

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

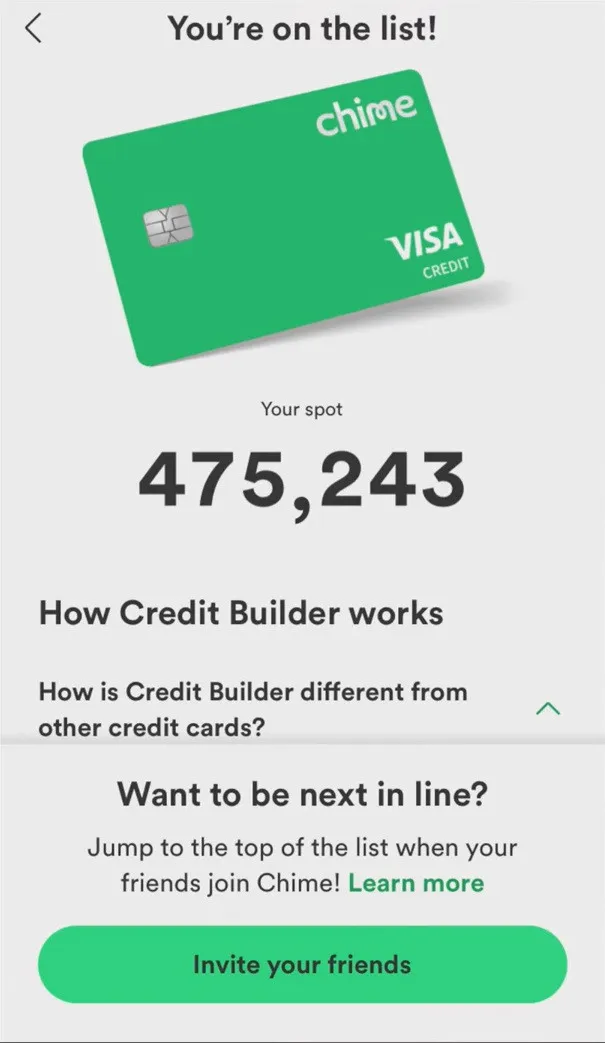

Chime offers a version of a credit card known as the Chime Credit Builder Card. This type of card will assist you in building your credit score. This card differs from others because no credit checks are necessary to pass, no annual fees or interest charges, and no minimum security deposit is required.

You can transact with this card where Visa is accepted. Furthermore, the credit limit is adjustable. Cash from Chime Spending Account that you transfer to your Credit Builder account identifies how much available money you can spend on your card. Make sure to read through this article to learn more about Chime cards.

Chime's ATM is compatible with MoneyPass and the VisaPlus Alliance. More than 60,000 fee-free ATMs are available, such as those located in popular retail stores like Walgreens, 7-Eleven, and Target. Withdrawing money from an ATM that is not part of Chime's network will have you incur an out-of-network fee. Chime's website and mobile app include an ATM and Cash Back Finder. The app's most recent version consists of an ATM Map feature that displays ATMs near your current location.

The Credit Builder Card intends to assist you in establishing credit. It has no annual fees, no interest rates, and an adjustable credit limit, which helps build your credit score. Continuous use of your credit card can assist you in developing a payment history that will increase your creditworthiness.

Additionally, no minimum security deposit is required for a credit builder card, and no credit checks are required. You must first open a Chime Spending Account with at least $200 in deposits made within the previous year to be qualified for the Chime Credit Builder Visa Credit Card.

Your credit limit is the amount you transfer from your Chime Spending Account to your Credit Builder. These unique features will assist you on your credit journey. However, you must open a spending account with Chime to utilize this advantage.

Remember that credit bureaus track your payment history. Hence paying on time is essential. Payment failure may result in card deactivation until the settlement of the balance. Your credit score may suffer if your payment exceeds 30 days.

How to activate your Chime Card by using a mobile number?

Follow these simple steps:

Note: You can call the Chime card activation number from 7:00 am to 7:00 pm, Monday to Saturday, and from 9:00 am to 5:00 pm on Sunday.

Follow these instructions to activate your Chime Card online:

The metal card is an edge-to-edge metal, metallic emerald green finish, and raised varnish branding, giving you a premium feel since this card is for Chime members who will compete in the metal card challenge. However, the challenge is only available for Chime members with a Credit Builder Card. For a Member to receive a Limited-Edition Metal Chime Visa Metal Card, some conditions must meet, which you can read here: chime.com/go-metal-with-credit-promotion-rules-chime-members.

Members will receive Chime's standard replacement card if their Metal Card expires or if it is lost, stolen, or damaged. Members will receive Chime's standard replacement card if their Metal Card expires or if it is lost, stolen, or damaged. Take note though that with or without prior notice, Chime holds the right to change the terms of the offer or terminate the client's registration at any time.

Kids below 18 years old cannot open a Chime account. For older kids who work and have a steady source of income, the Chime debit card is a recommended option.

The Member Services team is always available to assist. You can call the customer service number at +1-844-244-6363. Another way is to reach them 24/7 via the Chime app's customer support tab or email at [email protected].

Chime does not provide cardless ATM withdrawals, which means you cannot withdraw cash from Chime if you do not have your debit card with you.

Although Chime provides fee-free withdrawals from all ATMs nationwide, it is not possible to withdraw cash/funds from any ATMs without a card. As a result, the only way to withdraw money from Chime is to use your debit card at an ATM or over-the-counter at most major banks or credit union branches, where you must also show your debit card.

The Chime login account allows users to access their accounts through the official website. Follow the simple steps outlined below:

Customers who use the Chime login app can also use the Chime login on mobile phones designed for Android and iOS users.

You can access the "Settings" page from the drop-down menu by logging in to your online account through the official chime website. Keep in mind that if you have trouble changing your account details, don't hesitate to communicate with the customer service representatives through the official website.

Checking the balance on your Chime card is as simple as checking your Chime Spending Account balance. You have the option to link the Chime debit card to the Chime spending account rather than the savings account.

You may check the balance using your Chime mobile device app by navigating to the Chime Spending Account area of the Chime app.

You may also use the in-app notification to determine how much money you have in your spending account.

You'll receive a transaction alert on your mobile app whenever you use your debit card to make a purchase. The pop-up displays the amount deducted and the balance remaining in the account.

It costs nothing to open a Chime Spending Account, and it takes less than two minutes. Here's how to fill out an online application:

Typically, calling your bank or credit card company is the best option to resolve the problem.

When there is a refused payment, your credit card company or bank may inform Chime of the reason for the decline.

Declined transactions by your credit card issuing bank are for two reasons; this could be due to a lack of cash, a frozen account, an incorrect credit card number or expiration date, and so on.

For instance, you had declined orders if you either input incorrect payment details (most frequently a misspelled number when it entered debit/credit card data) or insufficient funds on the card (payment details with no funds available).

If your card is lost or stolen, you can request a replacement through the app.

First, double-check that your mailing address is correct in the app's Personal Information section.

If Chime has already printed your card, you should receive your replacement card in 7 to 10 business days. Your old card will be deactivated, and until your new card comes, you'll have access to a temporary digital card in Settings.

If you asked for a replacement card because it was damaged, the damaged card would remain active until you activate your new card. It can turn off transactions at any time in the app's Settings.

ChimeBot in the app can help you right away should you need assistance on this. You can also contact Chime Customer Service via phone or email.

Some financial organizations, including Chime, offer virtual credit cards to make internet purchases more secure for customers. When shopping online, using a virtual credit card can help protect your credit card number and important account information. Chime aims that there is no compromised account or being overcharged on subscription-based services.

To protect the account from being overcharged, Chime allows users to establish a maximum spend or charge limit on the card. You can also restrict the use of a virtual credit card number to a particular retailer, thus preventing the card from being used elsewhere.

With Chime's cash deposit partners, you may deposit cash in your Chime Spending Account at retail locations including Walmart and 7-Eleven. Inquire with the cashier about making a direct deposit to your Chime Spending Account. Every 24 hours, you can make up to three deposits.

You can deposit cash into your Chime Spending Account for free at any Walgreens location. Other money transfer services impose fees per transaction to add funds to your Chime Spending Account.

Your issuing bank may have placed a hold on your debit card. It frequently occurs when you repeatedly input an incorrect PIN at an ATM.

Your issuing bank may occasionally reject a transaction due to a lack of funds. It can happen if you have temporary authorization for other transactions in your account. An appointment can reduce the available balance in your account by blocking the transaction amount.

A Chime credit card allows the cardholder to borrow money from a financial institution, usually a bank. It's constructed of metal and is green in color with the brand name Chime on the right upper left of the card. It is sturdy to hold, and you don't have to worry about scratches or wear-outs with its metallic build with no further customization. However, it would help to keep your card safe at all expenses.