Intro

Considering Starling Bank and Digital International Bank but can't decide which one to sign-up with? Here's an updated comparison of these 2 banks to help you decide.

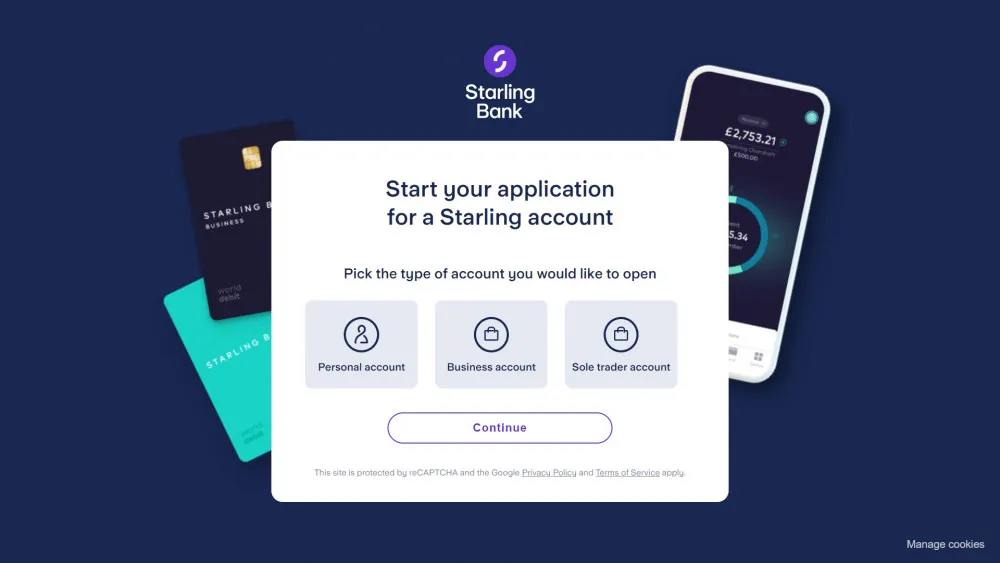

As of this writing, residents of 40 countries are eligible to open an account with Starling Bank. Most of the countries they support are in Europe but it's worth noting that they accept US and UK residents.

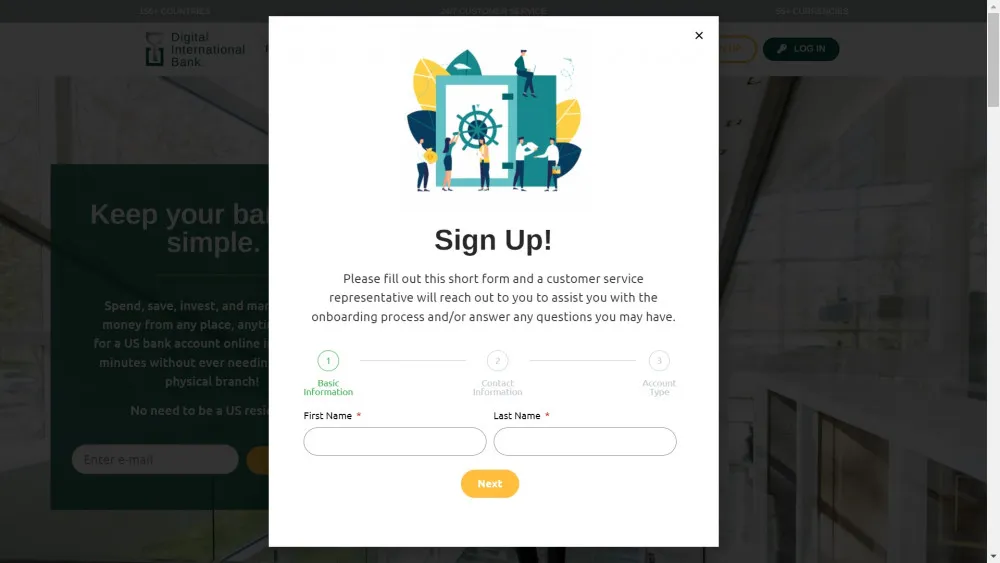

Digital International Bank accepts user registrations from more than 150 countries including US and UK residents. That gives DIB the edge over its competitor as it is more welcoming to users from across the globe.

Starling currently supports 18 currencies including USD, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, JPY, NOK, PLN, RON, SEK, and ZAR. That's quite a for digital bank so it's an advantage for people who are using various currencies./p>

In comparison, DIB supports over 55 currencies so if you'd like to avoid the high cost of converting one currency to another then this you'd definitely benefit from this bank's specific feature.

As a Starling Bank client, you'll be eligible to get a contactless Mastercard debit card. As for DIB clients, users are provided with a Visa debit card. Both of these brands are highly popular so it's basically a tie.

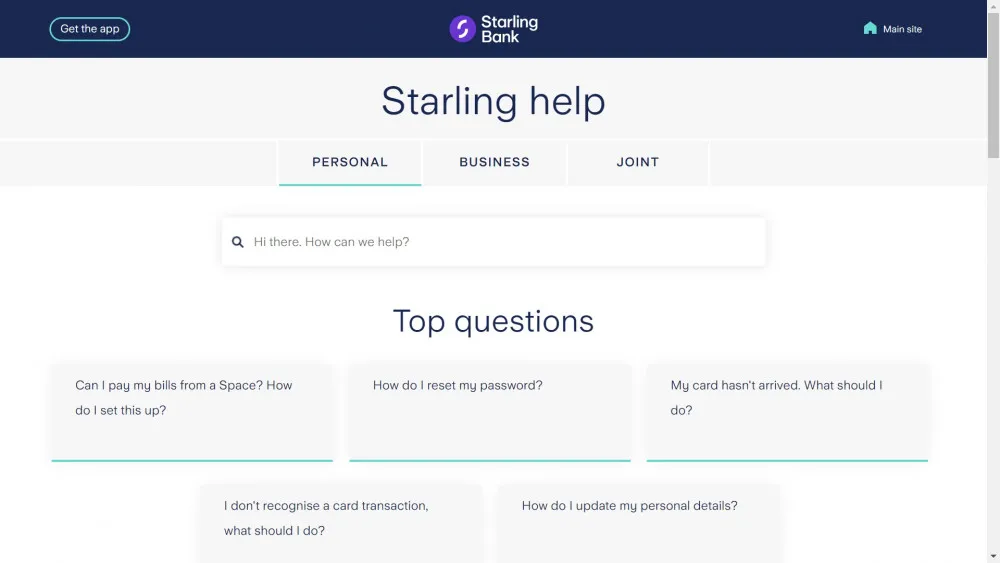

For any questions or concerns regarding your digital bank account with Starling, there are 3 options for contacting their support team: phone, email or live chat. This is an advantage since most digital banks nowadays have already removed phone support so to know that Starling still offers this method of communication is good news especially for those who prefer the traditional way of getting client support.

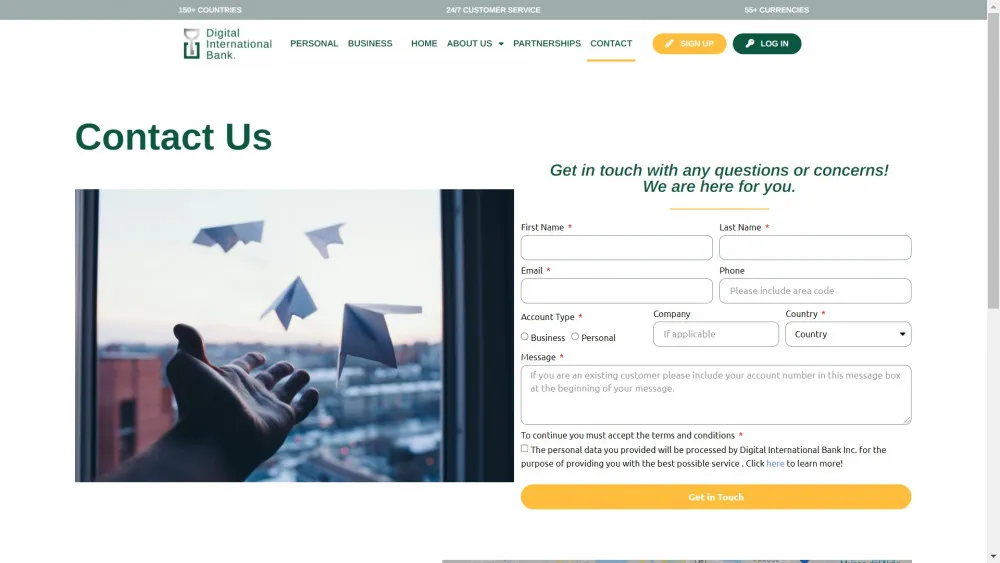

For Digital International Bank clients, there are also 3 ways to contact their customer service department and this can be done via phone, email or video chat. What makes DIB a little more advantageous than its competitor is that it offers a live video chat support so customers will be able to see a live person for a more realistic support experience.

Starling is UK's first digital bank and it currently has over 2 million clients. What makes this bank highly popular in the industry is that its app has various money management features that they can take advantage of.

As for Digital International Bank, it is widely know for providing a hybrid banking service for their clients. It is capable of providing financial services to users from across the globe and is a licensed bank under the US federal law so there's no question about their reliability and safety of funds.

It is indeed hard to decide if you're comparing 2 established names in the digital banking industry. Starling has built a name particularly for UK users with its user-friendly app that has various money management features while Digital International Bank has also established itself as a US licensed bank with a hybrid service that gives the best of traditional and digital banking for their clients. Overall, you have 2 pretty good choices but if you'd like to fully maximize your digital banking experience, then DIB is the better option.