Launched in 2016, PayPal Credit, formerly known as "Bill Me Later", is a revolving or open-end virtual credit card account that comes with a reusable credit line linked into your PayPal account, therefore allowing you to pay for purchases instantly or over time. Applying for this card is hassle-free, it's easy to use, and it's always usable whenever you go. The PayPal Credit program is offered by Synchrony Bank and is subject to credit approval.

Since it is not a physical card, you cannot use it at any brick-and-mortar stores. PayPal Credit is purely online-based.

You can use it at any merchant websites that offers PayPal as a payment option. To pay for purchased items, simply checkout by selecting PayPal as your payment method. If you don’t want to pay using your remaining PayPal balance, you can select the PayPal Credit pop-up button to make it as your preferred payment option. You can use this in more than a million of stores and merchant websites accepting PayPal as a method of payment.

In a nutshell, PayPal Credit's key significance is the ability to use it to pay for products and services when you don’t have sufficient funds in your PayPal wallet.

When applying for PayPal Credit, you only need to provide some personal information such as the last 4 digits of your Social Security Number, your date of birth, post-taxes and expressing agreement to the terms and conditions.

You can know the status of your application after a few seconds. Upon approval, your PayPal Credit will be instantly linked to your PayPal account. You will have the option of using it as your payment option each time you elect to pay for items with PayPal.

Remember: You need to have a PayPal account before you can apply for PayPal Credit.

If you purchased $99 or more through PayPal wallet, you are given 6 months to pay your bill in full. In the event that you failed to pay, you'll be charged with interest ranging from 19.99% to 23.99% variable APR starting from the date of purchase.

As a variable, expect the APR to fluctuate along with prevailing prime interest rate. The minimum interest charge is $2.

For goods and products not purchased through PayPal, you will only receive promotional financing if the retailer offers it.

After you get approved and accepted the terms and condition, PayPal will offer you a $250 credit limit. If you pay in time, PayPal will review your account and may choose to increase your credit limit. There is also a chance that you can have your credit limit decreased if you miss paying on time.

Yes. You may call the PayPal customer service to request a credit line increase. The PayPal Credit account holder, Synchrony Bank, may choose to increase your credit limit at any time, even after the purchase has been approved. Updating your account profile and income information may help you qualify for future credit line increases.

PayPal Credit allows users to spread the cost of their purchase over a variety of repayments when they check out with selected merchants. To help spread the cost of larger purchases in a more manageable manner, these instalment plans differ by merchant. Various installment plans give users the option to set monthly repayment term over a period ranging from 6 to 48 months.

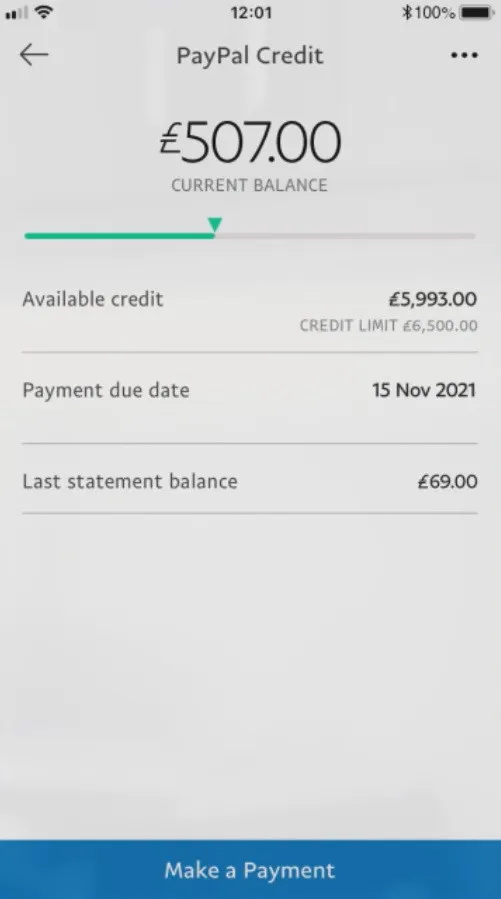

By simply logging into your account and clicking "Make a Payment", you can easily make a payment from your PayPal balance, bank account or debit card at any time.

What's worth mentioning is that PayPal Credit has zero annual fee. That means you won't need to pay for anything to maintain your account.

As of this time, PayPal Credit is only available to PayPal users in the United States and the United Kingdom.

Yes. You instantly become eligible for PayPal’s Buyer Protection the moment you purchase an item online using your PayPal. This means that in event that your ordered items don’t arrive or is different from the seller's description, you will be reimbursed by PayPal Buyer Protection.

To keep track of all your transactions using PayPal Credit, simply log in to your account and click "PayPal Credit", a page with a list of your activity will show up. To see your statements, just click "See Statements". You can also download your statement of account as a PDF file.

Yes. Since October 2019, PayPal has started reporting credit payment activities to the three chief credit bureaus of TransUnion, Experian and Equifax. Therefore, if you consistently pay your credit on time, you will increase your credit score.