Digital International Bank or DIB is a digital bank that is based in San Juan, Puerto Rico. Established in 2017, it is a fully licensed US bank and is regulated by the Office of the Commissioner of Financial Institutions (OCIF) in Puerto Rico (license # IFE-40).

DIB’s service is more focused on "hybrid banking" which brings together the benefits of both online and traditional banks. They also provide personal service wherein you can have a personal banker or a dedicated account executive to handle all of your banking activities and needs.

| 🏦 Headquarters | San Juan, Puerto Rico |

| 📜 License | Office of the Commissioner of Financial Institutions |

| 👤 Account | Personal, Business |

| 💳 Card | Visa |

| 📱 App | None |

| 💁 Support | Phone, Email, Video Chat |

There are 2 types of accounts that are offered by DIB:

DIB's accounts are multi-currency accounts, which can be very advantageous especially if you're going to send or receive money from anywhere in the world in order to avoid those costly exchange fees. You have the choice of holding it in USD or EUR as well.

Here's the deal:

DIB features a fully digital onboarding process so there's actually no need to ever visit their physical branch. They also accept clients who are non-US citizens or residents so even if you're from the UK or Australia, you'll be able to open an account with this bank.

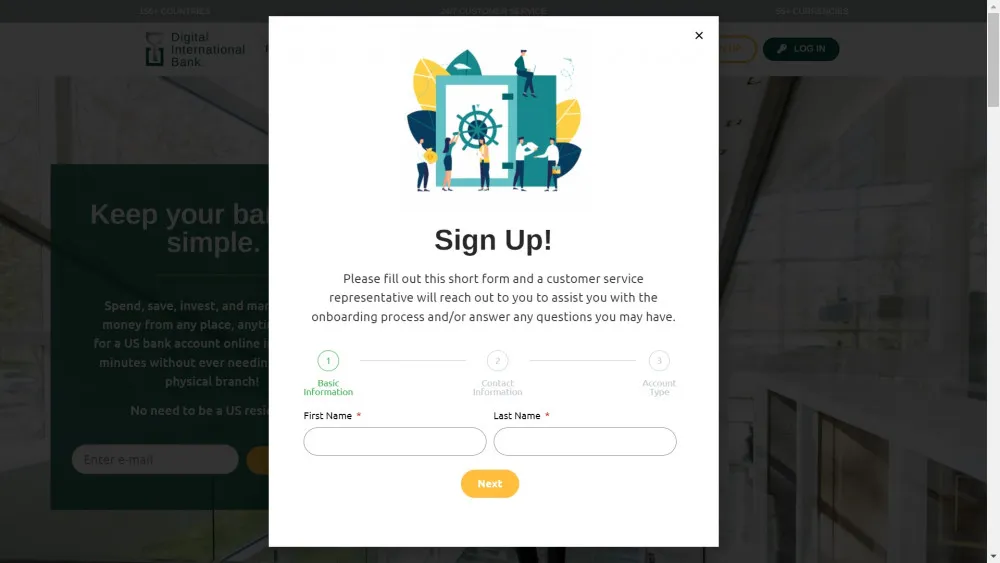

Opening a Digital International Bank account can be easily done only using a computer or even a smartphone. All you have to do is access their website www.bankdib.com and click on the "Sign up" button. Then, you'll be asked for your first and last name, your contact information including your phone number, country and email address, and the type of account that you'd like to open with them.

After filling out the form, expect to get a call from one of their representatives so they can continue and finalize the onboarding process.

As a DIB client, you're eligible to have a Visa debit card that you can use anywhere in the world on establishments, shops and services that accept this brand. What's interesting about the Digital International Bank card is that it won't require you to fund it with a minimum amount in order to maintain one (but of course it needs to have funds if you're going to use it). This is a lot more convenient as compared to prepaid cards that are offered by traditional banks, which would usually have minimum balance requirements.

DIB's exchange rates are a lot more favorable as compared to other digital banks out there. This is possible through their current partnership with Western Union Business Solutions (WUBS). This gives them the advantage of optimizing cross-border payments so they can provide the right international payment solutions. DIB currently supports over 55 currencies so there's a high chance that your local currency is included.

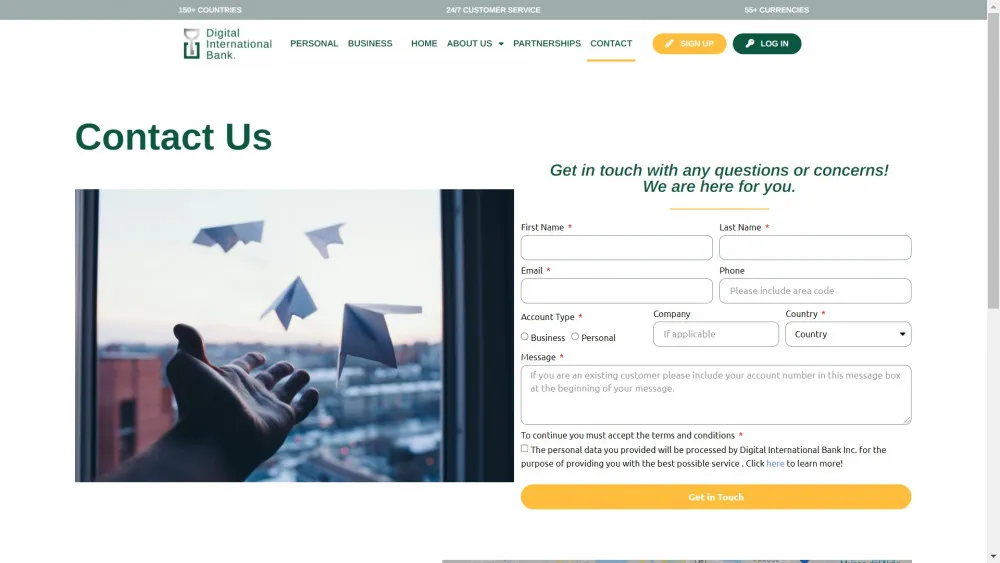

Getting in touch with the customer service department is the best action to take for any issues, concerns or questions about your DIB account.

The good news is that support is available 24/7, which means you'll be able to get assistance or help from them at any time of the day and not only during business hours.

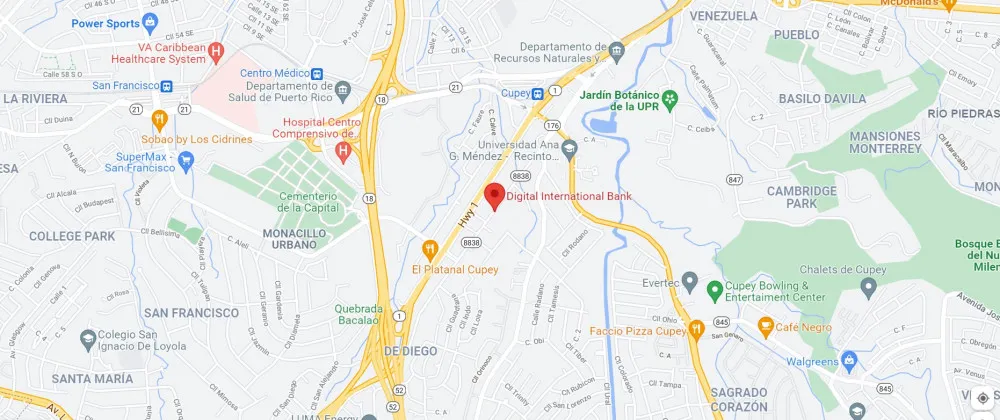

In case you're in Puerto Rico and would like to visit their office, here's the company's address:

Citi Towers, 250 Ponce de Léon Ave. Suite

#502, San Juan, PR 00918

Note: There's really no need to go to their headquarters since all banking activities and transactions can be done online. If you need to talk to a real person then simply giving them a call is the easiest way.

For phone support, they can be reached at +1-787-945-7875. There's also a video chat support, which we find to be very convenient since it's much easier to communicate this way since we can see the Digital International Bank customer service agents face-to-face and issues are resolved much more quickly.

Email support is also available so if you prefer this method of communication then you can send your message to [email protected]. Keep in mind that responses are not immediate if you choose this option. When we did our test, we were able to get a reply from the Digital International Bank customer service department in a few hours.

What makes Digital International Bank different from other digital banks out there is that it doesn't focus solely on the perks of digital banking but more on hybrid banking. This makes it even more ideal for most users since not everyone is still open to the idea of digital banking. The credibility of this bank is certainly not questionable since they have a license from a financial regulator that is highly regarded to be very strict with their licensees. Their personal service feature is also worth mentioning. While most digital banks highlight their self-serve features, DIB takes it into a more personal level by assigning a dedicated account executive to handle all of your banking activities and needs.

Digital International Bank definitely lives up to its name as a digital bank that caters to international clients so if you're looking for a safe and legit digital bank that has top notch service then DIB is worth considering.